An overpayment occurs when you receive unemployment insurance (UI) benefits you are not entitled to.

These may include:

- You made a mistake when claiming weekly benefits

- You were not ready, willing and able to work

- You did not complete the required work search activities.

- You knowingly gave DEW false or misleading information when filing a claim or claiming weekly benefits.

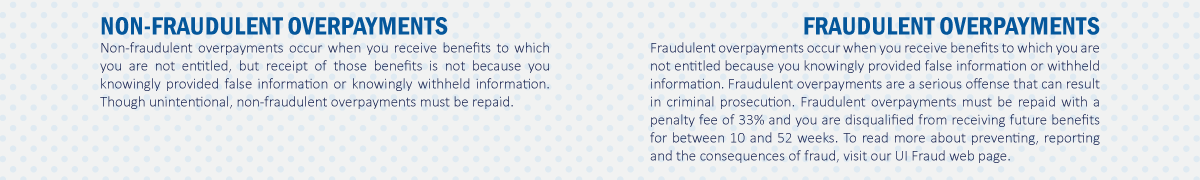

The S.C. Department of Employment and Workforce (DEW) classifies overpayments of UI benefits in two categories: non-fraudulent overpayments and fraudulent overpayments.

Overpayment Notification

If you have been overpaid for UI benefits, you will receive a Notice of Overpayment of Benefits by mail to your address that is on record with DEW. It is the claimant’s responsibility to update your contact information (address and phone number) within your portal. You can change this by logging into your MyBenefits portal and clicking the Change Personal Info tab.

In addition to the written notice by mail, an Overpayment notice will also be displayed within your MyBenefits Portal under MyDocuments tab.

The Overpayment Notice will show:

- The amount you were overpaid, including any penalty fees associated with the overpayment

- Explains why you were overpaid

- Provides instructions on how to request a payment plan

- Gives you information about your right to appeal and/or apply for a waiver of No Fault Overpayment.

- Repaying an Overpayment

-

Overpayments can be repaid in full or by setting up a monthly payment plan with DEW.

Here are the different ways you can submit repayments:

Online via MyBenefits using a debit card, credit card or electronic check. (Please note that an online convenience charge will be applied to your payment amount. The convenience charge is administered by a third party and is determined by the method or amount of the payment. Click here for a step-by-step guide.)

By mail with a check or money order to the address listed below – be sure to include your full name, full claimant ID or the last four digits of your social security number.

By setting up an automatic draft from your bank account.

By setting up a monthly payment plan via MyBenefits.

By calling to set up a monthly payment plan. You may experience a longer hold time than normal; we appreciate your patience.

Address:

S.C. Department of Employment and Workforce

Collections Unit

P.O. Box 2644

Columbia, SC 29202Phone: 1-866-831-1724 | Relay 711

Payment Plans for Overpayments

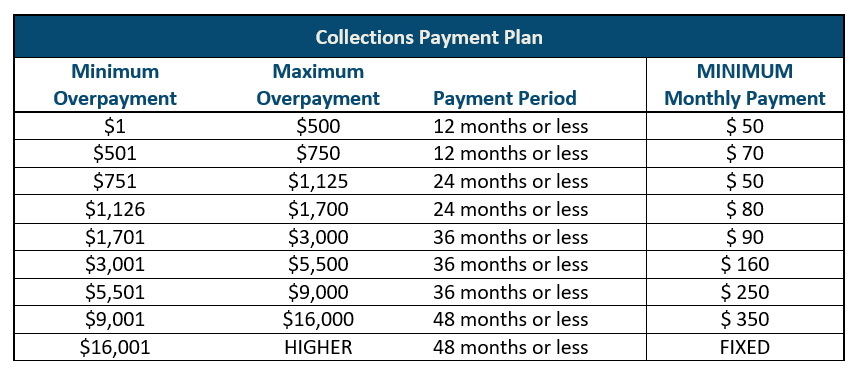

If you are unable to repay your overpayment in full, you can enter into a formal agreement with DEW to pay the debt through monthly installments of acceptable repayment amounts, by logging on to your MyBenefits. You can locate your minimum monthly payment based on the following parameters:

Ready to create a payment plan? Click here for a step-by-step tutorial.

If you are currently collecting UI benefits, you cannot set up a payment plan. By law, any available UI benefits you are found entitled to must be used to repay your overpayment. Once the overpayment has been repaid, any remaining balance (Ex. penalty fees) will be your responsibility to repay. UI benefits cannot be used to pay penalty fees.

-

Failing to Repay an Overpayment

-

If you do not pay the debt in full once you have been notified of an overpayment, DEW can take action to recover the debt including:

Withholding your wages if you are currently employed.

Deducting the money owed from your federal and/or state income tax refunds.

Deducting your debt from any other money owed to you by the state.

Offset of Lottery Winnings.You can avoid alternative collection methods by repaying the debt in full. After receiving the Notice of Overpayment of Benefits take immediate action, call the Overpayment Unit at 803-737-2490 | Relay 711.

Wage Garnishment

DEW has the right to recoup any overpayment balance through wage withholding. If DEW intercepts wages, we will request your employer to withhold twenty-five percent (25%) of the net wages for each pay period until the total liability has been paid in full.

Income Tax Interception Programs

Treasury Offset Program

The Treasury Offset Program (TOP) is a federal program that collects delinquent debts owed to federal and state agencies by offsetting an individual’s federal income tax refund. DEW is not required by law to get your permission prior to submitting your unpaid liability to TOP.

If you owe money to DEW because of a fraudulent overpayment or if you fail to properly report your weekly earnings, DEW may use TOP to offset your federal income tax refund to satisfy the debt.

Prior to submitting overpayment debt to TOP, DEW must have determined that your debt is valid and legally enforceable, sent you notices about your debt to your address on record, and provided you with opportunities to resolve or dispute your debt with the agency.

After receiving notification, you have 60 days to pay your debt in full, establish an acceptable payment plan or provide bankruptcy information.

If you do not take one of these actions, the information regarding your debt will be sent to the TOP database. Additionally, failure to meet the terms of your payment plan will also result in your debt being referred to TOP.

Before you receive a federal tax refund, the database is searched to see if you owe a delinquent debt. If your debt is in the database, your federal income tax refund will be used to repay your debt owed to DEW as well as a $18.43 service charge from the IRS. When your payment is taken, a letter will be sent to you by the IRS regarding the action.State Setoff Debt Program

The S.C. Setoff Debt Program (SOD) was created by state law enabling South Carolina agencies to report any delinquent debts to the S.C. Department of Revenue (SCDOR). SCDOR then uses an individual’s state income tax refund to repay the debt to the state agency and collects a charge of $25 for processing.

Prior to submitting overpayment debt to SOD, DEW must have determined that your debt is valid and legally enforceable, sent you notices about your debt to your address on record, and provided you with opportunities to resolve or dispute your debt with the agency.

After receiving notification, you have 30 days to pay your debt in full, or provide bankruptcy information.

If you do not take one of these actions, the information regarding your debt will be sent to the SCDOR database.

If your delinquent debt is offset used by SOD, SCDOR will notify you of the payment.Offset Lottery Winnings

DEW has the right to recoup any overpayment balance by offsetting any SC Education Lottery winnings. These will be applied to your debt and do not count as a scheduled payment.

Overpayments and Bankruptcy

Even when an overpayment debt has been discharged in bankruptcy, DEW has the right to recoup the overpayment through future UI benefits. Other methods of collection are not permitted for non-fraudulent overpayment, however, fraudulent overpayments may be declared non-dischargeable by the bankruptcy court and, therefore, a collectible debt following the conclusion of your bankruptcy case. In any event, administrative penalties associated with fraudulent overpayments are never discharged and can be collected following the lifting of the bankruptcy’s automatic stay.If you have additional questions about your options, please call 1-866-831-1724 | Relay 711 and follow the prompt for the Overpayments department.

- Appealing an Overpayment

-

If you disagree that you were overpaid or with the reason for an overpayment, you have the right to file an appeal. Complete the Notice of Appeal to the Appeal Tribunal form. Be sure to include your name and Social Security number and submit by mail or fax using the information listed below.

Address:

S.C. Department of Employment and Workforce

Appeal Tribunal

P.O. Box 995

Columbia, SC 29201Fax: 803-737-0287

Click here for more information about the appeals process.

NOTE: Any payment you make during the appeals process will be refunded if the decision is reversed and you are found eligible to receive benefits.

- Application for Waiver

-

Application for Waiver

Apply for a Waiver of No Fault Overpayment

If your overpayment is non-fraudulent and repayment of the debt would cause you extraordinary financial hardship, you may apply for waiver of the overpayment. An extraordinary financial hardship exists if repayment of the debt would directly result in the loss of or inability to obtain minimal necessities including food, medication, shelter and transportation for a substantial period of time.

In order to make a determination of waiver, DEW requires you to complete the Application for Waiver of No Fault Overpayment form accurately and truthfully. You will be required to submit documentation to support your request. You must complete and submit this form along with all supporting documentation by mail or fax using the information listed below within ten (10) calendar days of the mail date listed on your Notice of Overpayment of Benefits.Address:

S.C. Department of Employment and Workforce

UI Benefits Department

P.O. Box 1477

Columbia, SC 29202Email: imaging_fax@dew.sc.gov

Fax: 803-737-2640

If you have questions or need additional instruction regarding this form, call 1-866-831-1724 and follow the prompt for the Overpayments department.

- What is an overpayment?

-

An overpayment occurs when you receive unemployment insurance (UI) benefits you are not entitled to.

These may include:

- You made a mistake when claiming weekly benefits

- You were not ready, willing and able to work

- You did not complete the required work search activities. (This requirement is currently NOT in effect. DEW will notify claimants when this requirement is reinstated).

- You knowingly gave DEW false or misleading information when filing a claim or claiming weekly benefits.

The S.C. Department of Employment and Workforce (DEW) classifies overpayments of UI benefits in two categories: non-fraudulent overpayments and fraudulent overpayments.

- What should I do if I receive an overpayment notice?

-

If you have been overpaid for UI benefits, you will receive a Notice of Overpayment of Benefits by mail to your address on record with DEW. This will also be displayed within your MyBenefits Portal under Change Personal Info tab.

The Overpayment Notice will show:

- The amount you were overpaid, including any penalty fees associated with the overpayment

- Explains why you were overpaid

- Provides instructions on how to request a payment plan

- Gives you information about your right to appeal and/or apply for a Waiver of No Fault Overpayment.

You will need to either pay the overpayment in full or request a payment plan.

- Can I appeal my overpayment?

-

If you disagree with the decision that you were overpaid or with the reason for overpayment, you have the right to file an appeal. Complete the Notice of Appeal to the Appeal Tribunal form, include your name and Social Security number and submit by mail or fax using the information listed below.

NOTE: Any payment you make while in the appeals process will be refunded if the decision is reversed and you are found eligible to receive benefits.

Address:

S.C. Department of Employment and Workforce

Appeal Tribunal

P.O. Box 995

Columbia, SC 29201Fax: 803-737-0287

Click here for more information about the appeals process.

- How can I find the balance of my current debt?

-

To view your debt balance, you can:

- Sign in to your MyBenefits account

- The updated balance will be displayed on your portal homepage towards the top right.

- You can also select “create a payment plan” smart link.

If you have any remaining debt, the balance will update in your portal once payments are cleared.

- How do I pay DEW what I owe?

-

While overpayments can be repaid immediately in full, DEW understands that the circumstances of 2020 have created extreme situations for many individuals. The agency offers claimants reasonable payment plan options in order to balance their economic challenges with our responsibility to be good stewards of state and federal funds.

The minimum payment amounts, based on debt level and payment terms, are as follows:

- Can I use my credit or debit card to pay my debt?

-

DEW does accept electronic payments including debit or credit. Please note an online convenience charge will be applied to each payment amount. The convenience charge is administered by a third party, not DEW. Click here for a step-by-step guide.

To avoid a convenience-processing fee, you can make your payment by check or money order.

- How do I request a payment plan?

-

To set up a payment plan, login to your MyBenefits portal account and submit a request.

Call 1-866-831-1724 | Relay 711 and follow the prompt for the Overpayments department.

Write to:

SC Department of Employment and Workforce

Collections Unit

P.O. Box 2644

Columbia, SC 29202 - What happens if my tax refunds are seized?

-

You will receive a notice from the Internal Revenue Service (IRS) and/or Department of Revenue (DOR) that your tax refunds are being used to pay your overpayment debt. Prior to submitting your debt to the IRS and/or DOR, DEW must have determined that your debt is valid and legally enforceable, sent you notices about your debt to your address on record, and provided you with opportunities to resolve or dispute your debt with the agency. Please note that our agency may not receive your tax refunds for several weeks. If the amount taken out of your taxes is more than what you owe DEW, you will receive a refund from our agency. Allow at least six weeks from the date on the notice you received from the IRS and/or DOR for our office to process your refund. Refunds will be paid in the form of a check and will be mailed to the address on file, please log onto your portal to ensure your address is updated with your most recent address.

If your federal tax refund was seized, the IRS will charge an administrative fee of $18.43 for processing. If your state tax refund was seized, DOR will charge an administrative fee of $25 for processing.

- Why do I have an overpayment on my claim when I filed within the last few weeks?

-

In the past, you may have received Unemployment Insurance (UI) benefits to which you were not entitled. DEW is obligated to recover the overpaid benefits, using UI benefits you are currently eligible for, until the debt is settled.

- I returned my unemployment payment. Why do I still have a balance?

-

When your Unemployment Insurance benefits payment was issued, did you have any deductions (i.e. child support or federal income tax) withheld? If so, you are only returning the net amount. You are responsible to repay any deductions withheld to make up the gross weekly benefit amount you were actually paid.

- Why does the overpayment amount include money that was with help for child support and taxes?

-

Even though you did not receive the money withheld for child support and taxes, it counts towards your total overpayment. That is because the money we withhold was paid by DEW on your behalf to fulfill your child support and tax obligations.