Unemployment benefits are taxable income, meaning benefit payments must be reported on your federal tax return when filing taxes with the Internal Revenue Service (IRS). Your 1099-G will be sent to your mailing address on record the last week of January. You can also download your 1099-G income statement from your unemployment benefits portal. Remember, even if you were unemployed, you still have to file income taxes.

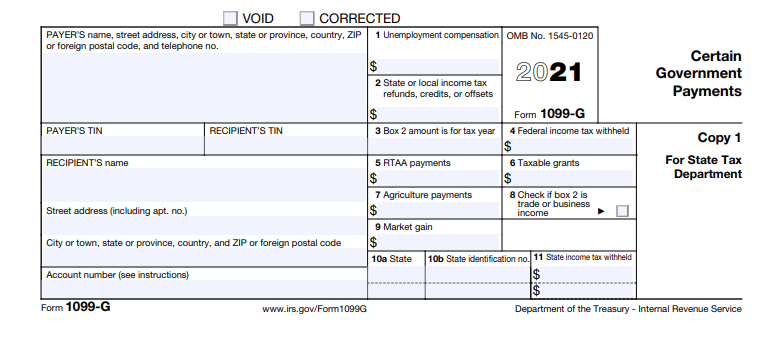

The most common use of the 1099-G is to report unemployment compensation, as well as any state or local income tax refunds you received that year. A 1099-G is a tax form from the IRS showing the amount of refund, credit, or interest issued to you in the calendar year filing from your individual income tax returns.

Please note: In order to view your 1099-G from any year, even if you have exhausted your benefits, you must register to access the MyBenefits Portal.

Learn how to access, view, and download your 1099-G form by reading the Finding Your 1099-G Guide.

Disputes

If you believe the amount listed on your 1099-G is inaccurate, then you can submit a dispute request through your unemployment benefits portal. Learn how to submit a dispute request by reading the Dispute Your 1099-G Guide.

If you believe you received a 1099-G in error due to fraud, please complete the identity theft fraud survey and include information for us to contact you. The fraud Department will promptly reach out to you.

For fraud issues, it will be necessary to file a victim report with your local police and provide a signed copy to DEW. DEW may place an ID theft hold on your claim and it will then be necessary for you to provide documentation to prove your identity for future benefits.

Resources

A sample 1099-G is shown here: