Work Opportunity Tax Credit: Helping South Carolina Target Groups Find Employment

By Taylor Hendrix, Workforce Insights Analyst

Employment in South Carolina continues to grow at a robust pace with more than 2.3 million people employed as of February 2024, an increase of more than 67,000 since the same time last year.[1] Despite this growth, there are specific populations in the state that continue to have difficulty obtaining employment.

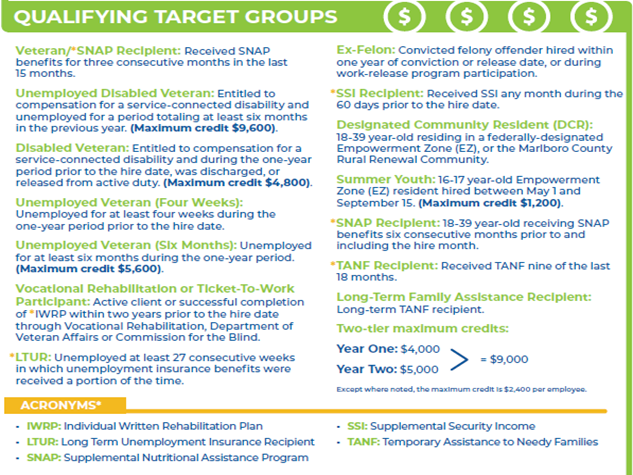

The state has several notable programs that benefit individuals who have consistently faced substantial barriers to becoming employed. One of these programs is the Work Opportunity Tax Credit (WOTC), a federal tax credit available to employers that hire individuals from a set of eligible target groups, including certain veterans, ex-felons, individuals receiving public assistance, and others, listed in more detail in the graphic below.

What is the Work Opportunity Tax Credit?

The WOTC is administered by the South Carolina Department of Employment and Workforce (SC DEW) and is designed to provide an incentive for businesses to hire individuals who fit into one of the various eligible target groups. The maximum credit can range from $1,200 to $9,600 for each qualifying hire, depending on how long they remain employed. There is no limit to the number of hires that can be claimed, but rehires do not qualify, and there are minimum retention requirements to earn this credit.

In fiscal year 2023, more than 36,000 certifications were requested, amounting to approximately $97 million in total potential credits. These figures were down from fiscal year 2022, when there were more than 42,000 certification requests with a total potential value of approximately $115 million. Employers interested in benefiting from this program should see the following list of eligible target groups for their hiring needs. For more information on this program, please see the attached brochure here.

[1] JobsEQ 2023Q3 QCEW data