|

If you received a letter informing you that you submitted either invalid or possibly inaccurate SOC codes with your first quarter 2024 reports, please know that the time to update your first quarter SOC codes has been extended to October 31, 2024. |

|---|

|

The first quarter that employers will be required to report SOC codes on their wage reports is the first quarter of 2024, due by April 30, 2024. |

|---|

To support employers, DEW has two tools to help you look up the correct SOC code for your employees:

- OccuCoder

- This look up job code matching application allows you to enter the search job titles to find the appropriate SOC code.

- SOC Code Descriptions Page

- This page on the DEW website allows you to quickly choose the area of work and then use the drop down menu to see all the SOC codes and their descriptions in that category.

- SOC Code Staffing Patterns by Industry Code Dashboard

- Census Code to SOC Code Crosswalk

- This Census Code to SOC Code Crosswalk allows you to match the census code to the appropriate SOC code. Census Codes highlighted in yellow have multiple potential SOC code matches.

- How do I use the Occucoder? [Video]

- Need more help or have other questions? Here are two resources to assist you:

- Entering the SOC Code into your SUITS account.

- If you need further guidance on how to enter the SOC into SUITS, you may log into your SUITS portal, available at https://uitax.dew.sc.gov/, and submit an inquiry using the “Request for Information” link. You can also call 1-866-831-1724 and select the option for employers (2-3-4) or for authorized agents (3-3-4).

- Choosing the right SOC code for the different jobs within your company.

- Still have questions about which SOC code fits for a particular job? First, be sure to try the “Occucoder,” an easy online tool that often quickly matches jobs with the SOC Codes. If that doesn’t help, you are welcome to schedule an appointment with a member of our LMI team through the following link.

- Entering the SOC Code into your SUITS account.

- Submitting a Wage Report: SOC Codes [Video]

- A SOC Codes Step-by-Step Guide: How to Report SOC Codes for Employees

- Live Look up through your SUITS account

- Bureau of Labor Statistics Manual

- This PDF format allows you to search for keywords (press and hold key “Ctrl” and press key “F”) to find your job title and matching SOC code.

SOC FAQ

- Is this required?

-

Yes! The system will save the codes entered so they will pre-fill for the subsequent quarters. Completing these fields will be required starting with the first quarter of 2024 wage reports, which are due by April 2024.

- What does it mean?

-

Standard Occupational Classification (SOC) codes are the federal standard used to classify workers into the specific category that best matches their job.

- What are they?

-

Each of your employees can be classified in one of 867 detailed occupations listed. SOC codes were first developed in 1980, and the current manual was published in 2018.

- How are they structured?

-

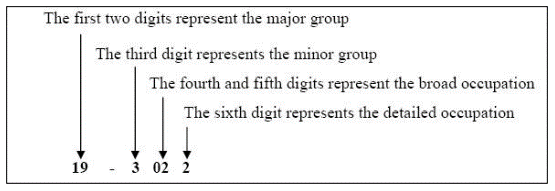

The SOC is a tiered occupational classification system with four levels: major group, minor group, broad occupation, and detailed occupation. The 23 major groups are broken down into 98 minor groups, followed by 459 broad occupations, and finally 867 detailed occupations.

- How do they help?

-

Having Standard Occupational Classification (SOC) codes for every employee improves data, decisions, and outcomes for employers, jobseekers, and SC's economy.

- Why is this new reporting necessary?

-

This began as a national push to create a uniform way to name specific gaps in, and share information about, the worker shortage. The first step is to identify which occupations, defined as day-to-day job duties and responsibilities, have the most unfilled positions now or in the foreseeable future. To benefit quickly from this effort, South Carolina is among the first dozen states to implement these measures.

With existing data, industries where employees are working are identified, but not the specific occupations. For instance, current workforce data considers all the following as healthcare industry workers: a medical doctor, a hospital receptionist, and a hospital cafeteria worker. This classification method hides critical information needed to effectively educate, train, and prepare our state workforce. Obtaining SOC codes will finally let South Carolina know the specific occupations making up its workforce and strategically invest in training and education to meet the needs of current and future businesses.

As South Carolina employers strive to find qualified workers, DEW will support K-12, higher education institutions, and credentialing entities, to prepare the workforce. DEW will collect SOC codes and share the data with the stakeholders in the workforce development pipeline – including the public – so that students and workers receive the skills needed to meet the demand.

The economy is strengthened when workers find jobs with a family-sustaining wage and employers fill open positions with prepared workers. Employers who submit this data are making a long-term investment in their ability to find the workers they need and in their children’s ability to build a successful career in South Carolina.

- How will it help employment?

-

The provisions in the Statewide Education and Workforce Development Act will improve recruitment and promote more effective investment in workforce training and development. Knowing the Standard Occupational Classification (SOC) codes that apply to each of your employees is the first step!

The Standard Occupational Classification (SOC) code data leads to more targeted training for the workers you need, which leads to better employment outcomes, and therefore more money flowing into our economy. Some of the people who use this data are industry, students considering career paths, jobseekers, career and employment counselors, educational institutions, and employers planning to set salary scales or locate a new business.

- How are "hours worked" related to SOC codes?

-

The number of hours an employee worked allows South Carolina to compare wages across occupations and even between regions of the state.

- What number of "hours worked" should be entered into the quarterly wage reports for employees in salaried positions?

-

The number of hours on which the employee's salary is based, regardless of the actual number of hours worked. For instance, if your standard work week is 40 hours, you would multiply the number of weeks your employee worked during the quarter by 40.

- Why doesn't every job title have its own code in the SOC?

-

The SOC Manual is used to examine and organize millions of jobs and tens of thousands of job titles in the economy into occupations based on their similarities as determined by the classification principles. The organizing principle of the SOC system is work performed rather than job title, so there are many fewer occupation codes in the SOC than there are jobs in the economy. Simply choose the SOC code that best matches your employee if you don't find a SOC code that is an exact match.

- What SOC code should be used for temporary workers?

-

Use the SOC code which corresponds with the highest skill level or education level among all the job tasks they do.

- What SOC code should be used for employees who "wear many hats," performing different roles in their daily tasks?

-

Use the SOC code which corresponds with the highest skill level or education level among all the job tasks they do. If more than one SOC code fits, use the one in which they spend more of their time doing.

- What is an example of how this information will be used?

-

The Coordinating Council for Workforce Development (CCWD) is a board made up of government agencies that are heavily invested in working together to support the workforce. Having better data about the jobs in the state, where they are, which industries hire which positions, etc., the CCWD can make better group decisions about how to help employers and support the state’s workers. There could be opportunities for education and training, transportation, childcare, and more.

Other groups such as economic developers, school counselors, and employers will also be able to use the information from SOC codes to promote South Carolina's prosperous and thriving economy.

- I submitted a wage report without SOC codes. How can I amend it?

-

Please view this brief tutorial that provides detailed instructions on how you can amend your wage reports.

- Need more help or have other questions?

-

Here are two resources to assist you with SOC Codes information:

- Entering the SOC Code into your SUITS account.

- If you need further guidance on how to enter the SOC into SUITS, you may log into your SUITS portal, available at https://uitax.dew.sc.gov/, and submit an inquiry using the “Request for Information” link. You can also call 1-866-831-1724 and select the option for employers (2-3-4) or for authorized agents (3-3-4).

- Choosing the right SOC code for the different jobs within your company.

- Still have questions about which SOC code fits for a particular job? First, be sure to try the “Occucoder,” an easy online tool that often quickly matches jobs with the SOC Codes. If that doesn’t help, you are welcome to schedule an appointment with a member of our LMI team through the following link.

- Entering the SOC Code into your SUITS account.